Dividend Yield and Dividend Payout Ratio Explained with Examples

When analyzing dividend-paying stocks, two important financial metrics are dividend yield and dividend payout ratio. While they sound similar, they serve different purposes in evaluating the income potential and financial health of a company. In this post, we’ll break down what these terms mean, how they’re calculated, and how to interpret them with simple examples.

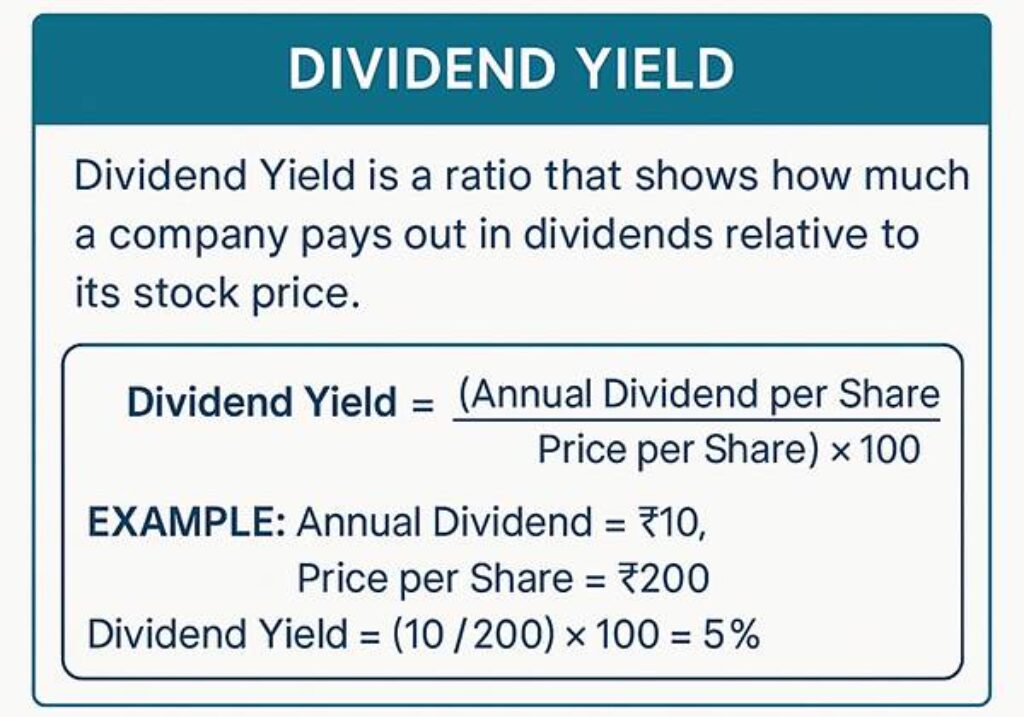

What is Dividend Yield?

Dividend Yield is a ratio that shows how much a company pays out in dividends each year relative to its stock price. It reflects the return on investment from dividends alone, regardless of capital appreciation.

Formula:

Dividend Yield = (Annual Dividend per Share / Price per Share) × 100

Example: Suppose Company A pays an annual dividend of ₹10 and the current share price is ₹200.

Dividend Yield = (10 / 200) × 100 = 5%

This means for every ₹100 invested, you earn ₹5 annually as dividend.

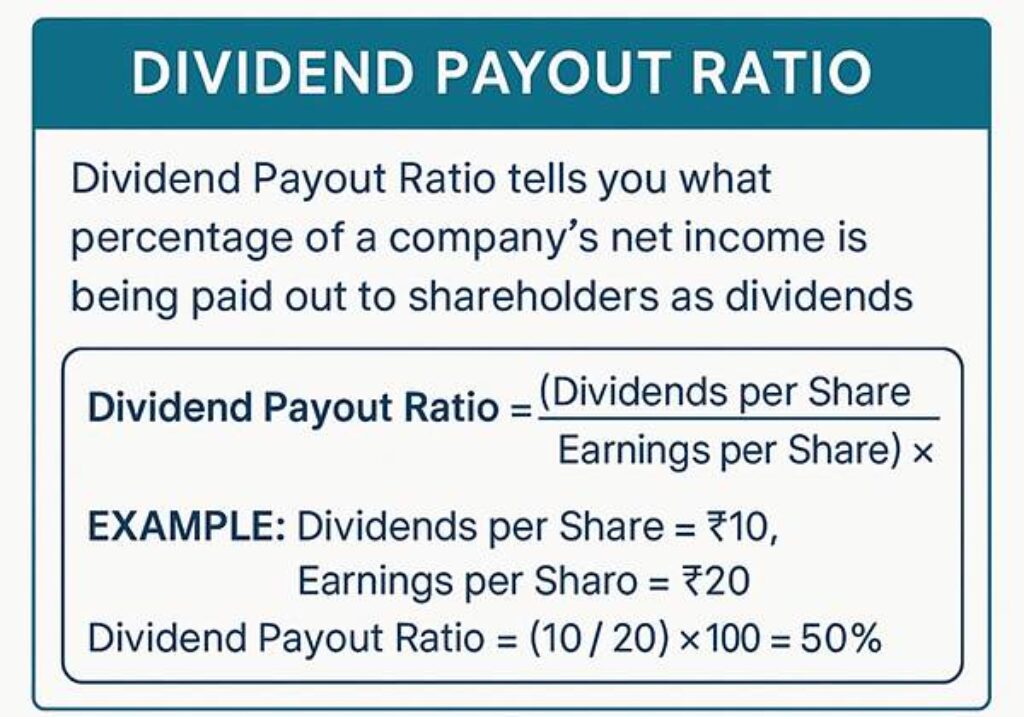

What is Dividend Payout Ratio?

The Dividend Payout Ratio tells you what percentage of a company’s net income is being paid out to shareholders as dividends. It helps evaluate the sustainability of dividends over the long term.

Formula:

Dividend Payout Ratio = (Dividends per Share / Earnings per Share) × 100

Example:

If Company A has an earnings per share (EPS) of ₹20 and it pays a ₹10 dividend:

Dividend Payout Ratio = (10 / 20) × 100 = 50%

This means the company is returning 50% of its profit to shareholders and retaining the rest for growth.

Key Differences Between Dividend Yield and Dividend Payout Ratio

| Metric | Purpose | Focuses On |

|---|---|---|

| Dividend Yield | Return on investment from dividends | Stock Price |

| Dividend Payout Ratio | Profit distribution to shareholders | Company Earnings |

Why Do These Ratios Matter to Investors?

- A high dividend yield can indicate attractive returns, but it might also be a red flag if it’s due to a falling share price.

- A moderate dividend payout ratio (typically 30%–60%) suggests the company is balancing dividend payments with reinvestment.

- A very high payout ratio (>80%) could signal risk if the company can’t sustain those payouts.

Conclusion

Understanding dividend yield and dividend payout ratio is crucial for any investor looking to build a consistent income from dividend-paying stocks. These two financial metrics provide insights into income potential, financial stability, and long-term viability of a company’s dividend policy.